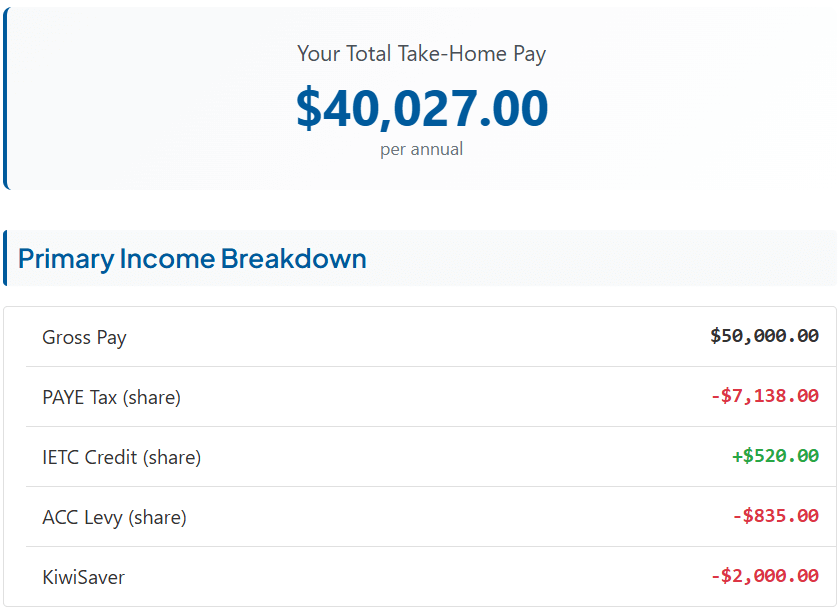

Calculate your exact New Zealand take-home pay in seconds. Our income tax calculator New Zealand tool provides instant, accurate results using the latest 2025/26 IRD tax brackets, KiwiSaver rates, and student loan thresholds.

Simply enter your salary details above and get a complete breakdown of PAYE tax, ACC levy, KiwiSaver contributions, student loan repayments, and your final weekly, fortnightly, monthly, or annual take-home pay.

NZ PAYE Calculator (2025/26)

This calculator provides an estimate for the 2025/26 tax year and is for informational purposes only. Tax is calculated on your total combined income using progressive rates. This tool does not constitute financial advice.

How to Use This Income Tax Calculator New Zealand

Step 1: Enter your gross salary (before tax) and select your pay frequency

Step 2: Choose your tax code – primary job (M, ME, SB) or secondary income (SH, SL)

Step 3: Select KiwiSaver contribution rate (3%, 4%, 6%, 8%, or 10%)

Step 4: Include student loan repayments if applicable

Step 5: Get instant results showing all deductions and net pay

Your Complete Tax Breakdown Includes

💰 Gross Income: Your total earnings before any deductions

🏛️ PAYE Tax: Progressive rates from 10.5% to 39% based on 2025/26 tax brackets

🛡️ ACC Levy: 1.67% on earnings up to $152,790 (2025/26 rate)

🏦 KiwiSaver: Your chosen contribution percentage (employer match included)

🎓 Student Loan: 12% on income above $24,128 threshold

✅ Take-Home Pay: Your actual net income after all deductions

Why Our Income Tax Calculator New Zealand Stands Out

- 2025/26 Tax Year Accurate – Updated with latest IRD rates and thresholds

- Multiple Income Streams – Handles primary and secondary employment correctly

- Real-Time Results – See changes instantly as you adjust figures

- Mobile Optimized – Calculate on any device, anywhere

- No Registration – Use immediately without signing up

- Comprehensive Coverage – Includes all major NZ tax deductions

New Zealand Tax Brackets 2025/26

| Income Range | Tax Rate |

|---|---|

| $0 – $15,600 | 10.5% |

| $15,601 – $53,500 | 17.5% |

| $53,501 – $78,100 | 30% |

| $78,101 – $180,000 | 33% |

| $180,001+ | 39% |

Use the calculator above to see exactly how these brackets affect your take-home pay.

Planning Your New Zealand Finances?

Understanding your take-home pay is crucial for budgeting and financial planning. Once you know your net income, compare it with living costs using our cost of living Australia vs New Zealand calculator to make informed relocation decisions.

For Australian tax calculations, use our Australian income tax calculator to compare take-home pay between countries.

Important Disclaimer

This income tax calculator New Zealand provides estimates based on 2025/26 IRD rates for general information only. Individual circumstances may vary. Consult a qualified tax advisor for personalized advice.