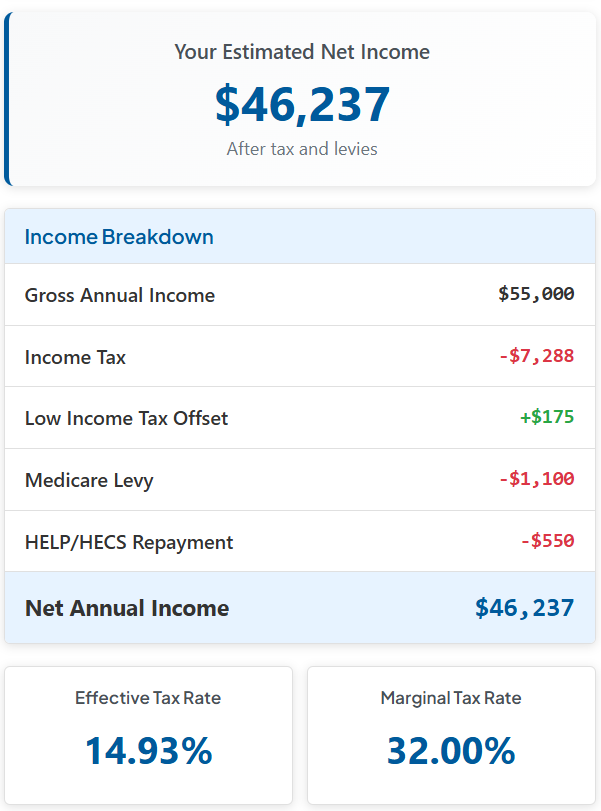

Cost of living Australia vs New Zealand decisions start with understanding your actual take-home pay. Whether you’re considering a career move, comparing job offers, or planning an international relocation, knowing your net Australian salary is crucial for making informed financial decisions.

Our comprehensive Australian Income Tax Calculator for the 2025-26 financial year provides instant, accurate calculations based on the latest ATO rates and thresholds. Discover exactly how much you’ll earn after tax, Medicare levy, student loan repayments, and other deductions.

Australian Income Tax Calculator

Disclaimer: This calculator provides estimates for the 2025-26 financial year. Results are indicative only and do not constitute financial advice. Consult a qualified tax professional for personalized advice.

Why Knowing Your Net Income Matters

Understanding your Australian net income is essential for accurate budgeting, negotiating salary, and planning your financial future. This calculator helps you see exactly how much you’ll take home after tax, Medicare levy, and (if applicable) HELP/HECS repayments—so you can make fully informed decisions, whether you’re considering a job offer, planning a move, or managing family finances.

- Tax brackets: Calculates what you owe at each income level.

- Medicare levy: See how health levies impact your salary.

- HELP/HECS: Instantly includes any student loan repayments.

- Effective and marginal rates: Understand both your total and bracket-specific tax rates.

Want to see how your net income compares to the cost of living in Australia? Try our cost of living calculator to get the full picture.

How to Use This Australian Tax Calculator

Step 1: Enter Your Income Details

- Annual taxable income: Your gross salary before any deductions

- Residency status: Australian resident vs foreign resident (different tax rates apply)

Step 2: Configure Health & Medicare Settings

- Private hospital cover: Affects Medicare Levy Surcharge calculations

- Family status: Important for Medicare Levy Surcharge thresholds

Step 3: Add Education & Personal Details

- HELP/HECS debt: Student loan repayments based on income thresholds

- Senior status: Different Medicare levy thresholds for over-65s

- Dependent children: Affects family income thresholds

Step 4: Get Instant Results

Your personalized breakdown includes:

- Gross income and net annual salary

- Income tax calculated using 2025-26 brackets

- Medicare levy (2% for most residents)

- Medicare Levy Surcharge (if applicable)

- HELP/HECS repayments (sliding scale based on income)

- Low Income Tax Offset (LITO) credits

- Effective tax rate and marginal tax rate

2025-26 Australian Tax Highlights

- Tax-Free Threshold: $18,200 (no tax on income below this amount)

- Medicare Levy: 2% for most Australian residents

- Top Tax Rate: 45% on income over $190,000 (plus Medicare levy)

- HELP Threshold: No repayments required under $54,435

Planning Your Move? Get the Complete Picture

Salary is only half the equation. To make informed decisions about living in Australia versus New Zealand, you need to understand both your earning potential AND your living expenses.

Next Steps for Complete Financial Planning:

- Calculate your take-home pay using the calculator above

- Compare living costs with our cost of living Australia vs New Zealand calculator to see expenses across major cities

- Research tax implications at the Australian Taxation Office for official 2025-26 rates and thresholds

Pro tip: A higher gross salary in Australia might result in similar or even lower take-home pay compared to New Zealand once you factor in different tax rates, living costs, and currency exchange rates.

Frequently Asked Questions

Q: Is this calculator accurate for the 2025-26 tax year?

A: Yes, all calculations use the latest ATO rates and thresholds effective from July 1, 2025.

Q: Can I use this if I’m not an Australian resident?

A: Absolutely. Select “Foreign Resident” for different tax rates (no tax-free threshold, no Medicare levy).

Q: How does this compare to New Zealand tax calculations?

A: Use our complementary New Zealand income tax calculator for direct comparisons.

Important Disclaimer

This calculator provides estimates for the 2025-26 Australian financial year using current ATO rates and thresholds. Results are for general information only and do not constitute professional tax advice. Individual circumstances may vary significantly. Always consult a qualified tax professional or registered tax agent for personalized advice.